Author Archives: Bluth

WallStreetBonuses Hopes You’re Staying Warm

Wall Street Bonuses Wishes All A Happy Thanksgiving Holiday

Wall Street sinks on news of probable government shutdown

Not much time left before the deadline, the country waits while its government plays this continuing game. The one party refuses to cooperate with the other, while the second party tolerates the tantrums of the first.

======================================

======================================

Mitt Romney Gave Bonuses In Order To Deplete Bain’s Cash, & Get Federal Bailout

You want bonuses, Wall Street style? Here are the ones Mitt Romney handed out at Bain in order to extort a government bailout for a failing company. It’s simply unbelievable. Tim Dickinson of RollingStone writes about it in an Aug. 29 column, having deciphered over 500 pages, heavily redacted, from Freedom Of Information Act (FOIA) requests concerning Bain, in the early 1990s when Mitt Romney was working there for the second time.

This is after Romney was given his little berth at Bain Capital. The parent company, Bain & Co., asked Romney to step back in and handle restructuring Bain’s considerable debt. This was 1991, and Bain was doing horribly, and putting Romney in charge did not solve things; the negotiations he attempted with their creditors were not successful. The creditors, you know, just wanted to be paid.

Therefore — since the FDIC had a significant stake in Bain — Romney threatened to basically ruin the company if the government didn’t help them out with money. He told the FDIC and the other companies Bain owed money to that he planned to hand out very large bonuses to the executives and management, thus depleting the cash reserves, if all the creditors would not agree to reduce Bain’s debt by 65%. He wanted to pay just 35 cents on the dollar of what Bain owed.

According to the paperwork, Romney was permitted to hand out bonuses regardless of performance.

And the debt-restructuring agreement said ALL the creditors had to say a change to 35 cents on the dollar was okay, or he’d carry out his bonus plan.

But a few of the creditors thought it was a bluff, and they called it. They refused. So he gave out bonuses large enough to alarm analysts, who advised the federal government that they believed Bain was headed for trouble.

Matt Taibbi, also in RollingStone, explains Romney’s business actions: Mitt was “looting the cash reserves.” Interesting that he did this as a general strategy and not simply when in takeover mode against another firm. In this instance, it was the serious, adult version of a child threatening to hold his breath until he gets what he wants. When adults do it, they’re typically threatening to blow up something. And Romney was threatening to destroy Bain if the government didn’t step in and take care of them financially.

That first threat did not achieve what he’d wanted. So he tried again, announcing he’d do another bonus round of cash to management if all Bain’s creditors didn’t agree to — a new amount — 30 cents on the dollar for what Bain owed. As was evident in the documents, the FDIC was facing significant losses to the value of their piece of Bain. Analysts told the federal government that at this point in time (Aug. 1992) that Bain had defaulted on the revenue targets of the loan agreement they had, and was headed toward bankruptcy. They said Bain & Company had “no value as a going concern.”

Bain got its bailout, of $10 million, and it is difficult to believe the FDIC didn’t pressure the other creditors to sign on to the debt agreement, in which Bain only had to pay its creditors 30 cents on the dollar. Because by this time Romney had already awarded that second round of bonuses.

He’d just extorted the U.S. government successfully.

Fine, Fine, Fine! ( Wall Street pays some big ones.)

On Wall Street, bonus time comes a little before fine season, usually. Fines — for improper practices and fraud by financial corporations — are exacted mostly by three federal agencies (the SEC, FINRA, and CFTC) and a huge host of state agencies. For the biggest banks and stock trading firms, this happens throughout the year, EVERY year.

Here are some of the biggest fines Wall Street firms and the Big Banks have had to pay in recent years:

1. $722 million, JPMorgan Chase — For its role in the 2009 wreckage of a sewer refinancing attempted in Jefferson County, Alabama, JPMorgan was fined this amount by the SEC. The bank allegedly paid bribes to county officials in order to get the refinancing contract with the county. The deal was fraught with derivatives as part of the loan. Jefferson County is now bankrupt, sewer rates for residents have skyrocketed, and they are in endless debt.

There were more municipalities to file for bankruptcy that year too, for very similar reasons, in multiple states.

2. $550 million, Goldman Sachs — This fine was demanded of Goldman Sachs in July 2010 (but was still pending, as of March 2011) by the SEC, who sued the Wall Street firm for fraud related to only one mortgage security.

Abacus 2007-AC1 was the name of that security. The Abacus deal involved John Paulson, famous hedge fund manager who has probably made more than anyone else in shorting funds. Goldman Sachs failed to disclose to investors — who were going long on the deal — that Mr. Paulson was involved in choosing the components of that bundle of mortgages… and that he was also betting against it.

3. $515 million, Bank of America — Fined in 2004 for permitting improper rapid trading of mutual funds in its Nations Fund. At least half was for investor restitution.

4. $285 million, Citigroup — In December 2011, Citigroup was fined this lordly sum relating to a CDO containing toxic subprime mortgages. It is still in question, as U.S. District Court Judge Jed Rakoff didn’t like it, since they are not required to admit to any guilt for the sales.

5. $280 million, JPMorgan Chase — In June 2011, JPMorgan Chase paid this huge fine for its “Squared CDO-2007” deal, which resembled the “Abacus” of Goldman Sachs. Just like Goldman, JPMorgan had failed to let investors know that another party betting against the fund had helped make it.

6. $215 million, Citigroup — Way back in 2002 Citigroup paid $215 mil to settle a case brought by the FTC claiming that part of their company, The Associates (later CitiFinancial) deceived customers to get them to refinance at interest rates amounting to usury.

7. $137 million, Bank of America — This may be one of the most egregious cases, with a sadly inadequate fine, of all the fraud, collusion and predatory practices seen in the Big Banks and stock firms during the last few years. It was found in 2010 that a conspiracy to rig bids on municipal bonds contracts had been carried out among the biggest banks. JPMorgan Chase, UBS, Wachovia, and others were implicated along with Bank of America. They took turns being “awarded” contracts in dozens of local bonds derivatives contracts.

The SEC demanded for its fine only $36 million; but another $101 million was added to the penalty by multiple state and federal agencies. It is estimated to have cost taxpayers over $1 billion.

……. As huge as these amounts seem, they are tiny in relation to the sums earned by the respective companies. For instance, what JPMorgan CHase paid for the Squared fines was less than 2 days’ income that quarter. In 2006, Citigroup grossed $38 billion from subprime home loans…. wait for it…. and their net profit that year was $28 billion.

Bonuses On Wall Street Sink In Importance; Rick Santorum Wants To Cook Us For Dinner. Tentacles and Protein Strings.

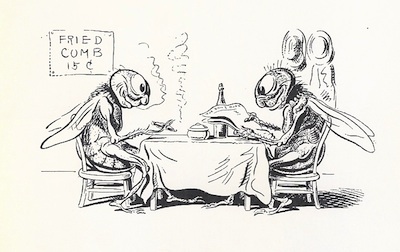

Wall Street bonuses — which are obviously a metaphor for the unfair reward system currently in place for huge sectors of society today — are hard to keep uppermost in my mind, because of the Republican presidential candidates, who are utterly mad.

Or else they’re just aliens. You think?

I have to consider the possibility. Others already have reached firm conclusions for themselves on the matter, for instance: Rall.com

But I have to do my own fact-checking. Or at least rumor-checking. So okay, quickly. On Ted Rall’s latest cartoon, in the link above, he quotes:

“We’re not here to serve the Earth. That is not the objective. Man is the objective.” — Rick Santorum

So the salient parts of the quote actually are:

“We’re…here to serve… Man.”

How predictable! And like a fool here I was, twirling towards freedom.

I think I caught a glimpse of the Republican candidates the other day, when my water bowl was being refilled and the cell door hung ajar behind the guard. They — the candidates — look different now and their disguises are off. If you can picture an orange pyramid about 8 feet tall made of spongy flesh, and thick tentacles writhing out of its top, you’ve got it. And don’t forget the skinny arms, sticking out from either side.

The Strain on Medicare.

Did Wall Street suggest that Rick Santorum open his mouth and start talking about all this religious stuff? Someone did. It’s a great way to channel the talk and attention away from the fact that the miscreants, or I should just say criminals, of the ruined economy aren’t in jail yet, and financial regulations haven’t yet been enacted that will prevent more of the same crimes.

I refuse to let the current stupid anti-contraception debate-posing-as-a-religious-liberty-debate, which the Republicans have unleashed in front of the media, prevent my seeing the economical sins they continue to commit. (Just to throw some religion at you.)

You shouldn’t look away from the economy, either.

Or from your need for health care coverage.

On the health care front, I’ve been trying to listen to the inner facts that I heard first from very right-wing, hardworking doctors. There’s some scary things to think about;, and everybody — right, left, green, libertarian, smurf, communist, all — should be concerned.

Just focusing for now on Medicare.

Doctors whose practices consist largely of Medicare patients are worried, because they see so many people who’ve been on Medicare for decades but are not that old; some are people who retired very early in their careers. Yes… think about early-retirers. Some, whose early retirement was based on a formerly-healthy retirement pension and/or savings, now sadly shrunken due to the cratering of the economy, really need Medicare, especially if they haven’t been able to afford to buy supplemental insurance at all. (But of course Medicare isn’t available to them until they’re the right age.)

And then there are the spouses of all retired people, many of whom never contributed much directly to Medicare themselves. People who didn’t work outside the home, and all that.

Add to this the fact that we’re living longer.

The typical Medicare recipient may now be using far, far more in medical care money than he contributed in an entire lifetime. This is what some doctors are saying. They may be absolutely correct; after all, they’re the ones who send the bills to Medicare for their own reimbursement. (It would be excellent to find some clear stats on this, like what procedures are common at certain ages, and how long people tend to live after retirement. I must get busy.)

It’s something to worry about. It means that medical costs have to be brought into a manageable range. And it means we have to somehow make the future of Medicare a fair thing for those who will be depending upon it in years to come.

It also means that income taxes for ALL of us should go up. Yes, probably the middle class too. No, not the poor. They’re poor! And all those outrageous tax loopholes for corporations and the rich should be closed. And financial transactions in the stock market MUST be taxed (I mean, who exactly decided they shouldn’t be??). And corporate taxes SHOULD GO UP. Capital gains should be taxed at MUCH MORE than 15% — maybe they should be taxed at the same rate as regular income, hey what a thought.

And finally, tax revenue must be diverted from something else it is currently being spent hugely on…. Hmmm, what could that be? (cough-war-cough)

Yes….. heroic efforts should be undertaken to fund health care. You see, it means staying alive. We all like to be alive. Without being alive, we have no fun.

Occupy Wall Street’s Mature Offspring, Doing Good.

Rachel Maddow’s optimistic report on the OccupyNevadaCounty (OWSNC) in California — and its action that resulted in the delaying of a family’s eviction due to foreclosure, until at least after the holidays — as I say, that report was maybe a little too optimistic. Wonderful, though.

It involved homeowner Stephen Merryweather, who was about to be evicted from his home the next morning, called the Occupy Nevada County’s foreclosure group, asking for help. The Occupiers arrived very early the next morning (when he was about to be kicked out) and Occupied his front lawn. They also called up the parties involved in the mortgage and the foreclosing action, which meant a Fannie Mae rep from California Pacific Brokers, and the sheriff. They talked, and the mortgage rep agreed to delay the action of putting a family out of its home a week and a half before Christmas.

It is to be wondered if such a scenario could take place in many other locations. This would require a lot of separate elements: An experienced, able local Occupy group to respond and negotiate with several different local authorities, for a start. The Occupy Nevada County members were noticeably older people, middle-aged, not 20-somethings. This was rather remarkable, since the media pictures of all other Occupy groups tend to portray very young people. But older people are more representative of homeowners in general. The entire event screams to the sky how much older people are needed in the Occupy movement.

The next thing you’d need to repeat the success is a local sheriff who’s willing to help the two other parties negotiate, and who is willing to hold off his dogs.

And then the mortgage people. If they’d been Bank of America or Wells Fargo, what might have been likely to happen? These big bad ones have not seemed concerned about their public images lately, but are extremely concerned about keeping their f’n money. (Even though it isn’t really theirs.)

Wall Street’s San Juan Rabbits. Big Banks Spread Their Bad Practices to Good Banks.

It is difficult to talk about daily life without a sense of ourselves being the prey that Wall Street and the biggest corporations bred and held in captivity just like the rabbits of San Juan Island. The San Juan rabbits were originally introduced to the island for hunting, were at some point simply abandoned into the wild, and now have bred a little too successfully, which is a problem. They have few natural enemies other than Man, so Man seems justified in getting really nasty in its methods to get the little guys. I don’t want to dwell on those methods, because the sadness of rabbit death is a distraction from the other issues I should be focusing on.

We’re a rich nation. In order to participate in the social interaction present on the internet, interactive TV and movies, the viewer needs at least one of the expensive devices on which to watch, listen, post messages, click on opinion polls, vote for a favorite, etc. There are so many customers of new and wonderful products that the media treats these things as if everyone has them. Consumers thus are conditioned and bred to have heightened appetites for exciting goods and services. Even poor kids at Christmas want the best of computer games, XBox, Wii, MP3 players and the like, because they are well informed about such items and have been accustomed to think the average person should naturally have them — even when parents are unemployed or facing financial problems. That’s not the kids’ fault; it’s a rare child who fully grasps the financial circumstances of his family, and plenty of parents try to prevent their kids’ knowing how bad things are. The parents may go out begging from the public to try to meet their kids’ desires; generous people often help, by giving them some of those very expensive toys; the sad cycle continues. Those families are now being bred for the hunt. And that’s an extreme example. A lot of us are San Juan stock already, due to our wish to —

1. own a home and taking out too much credit, being deceived by our lenders, cheated by our lenders, or

2. own a smartphone, or

3. own a computer tablet or one of the other wonderful devices which have now actually become a standard device for communicating, working, and the like. Yep, we’re rabbits on the run. Those devices alone, which we have learned to depend upon, incur more and more expense to keep running, to update, and so on. And don’t get me started about cable TV and how much it costs and how TV used to be free…

***************************

And now, I want to say a word about a growing contagion:

The Big Banks have infected the supposedly “Good” Banks with their insidious fee practices. No bank is good anymore.

The HuffingtonPost and some other public-interest groups compiled a list of banks they considered relatively “good,” all over the nation. These banks had little or no exposure to the mortgage crisis, did not invest heavily in the biggest perpetrators of mortgage schemes, etc. The list included small and local banks in every state they could find, and the aim was to find safe and suitable places for middle class people to do their banking.

Banks on this list are now participating in the egregious fees practices that the Big Banks do. For instance, at one unnamed bank, the new overdraft policies categorize consumer purchases in different ways, and by doing so, manage to charge fees on what the new federal legislation would otherwise prohibit charging a fee on.

The legislation says, generally, that each customer of the bank must be asked if he wants any purchase covered if it’s made without sufficient funds in the account. This is “opting in” to an overdraft — so if you try to use your check card in a store to buy an item, but your bank account doesn’t actually have enough, the purchase will go through but your bank will charge you a whopping fee, usually at least $25 and more often $35 or more. This overdraft protects you from inconvenience or embarrassment, but it’s terribly expensive.

If you do not tell your bank you want such protection, it will not cover the charge; your purchase simply gets declined, and nothing more happens. EXCEPT WHEN something more happens. Because they can categorize your purchases in different ways. Buying something in a store or online is considered a Point-of-Sale (POS) purchase, which requires your presence at the store, or your online confirmation of the purchase at the time it is being done. Well, there is another type of purchase, very, very common online: It’s the Recurring Charge. The subscription to an online magazine, or a dating membership, or movie service are all examples of this. This may be called something other than a POS charge by your bank, and they don’t have to decline, even when you didn’t opt in for overdrafts. They treat it as a special kind of purchase, as if it were a promissory note. Car payments and mortgage payments are often recurring charges and are important to cover. But a magazine subscription?? And it incurs fees when your account doesn’t have the money to cover it right there — Boy, does it incur fees.

Now, the fees. The bank in my example charges $36 for the first insufficient funds penalty. Then, if you don’t add some money to your account to take care of it, in a week you are charged another $36. Then soon, if you still haven’t covered it, you get charged $9 a day, every day you don’t add money to your account. A Netflix charge could cost you about $150 that month, if you forgot to make sure your account was completely funded.

Nice one, banks! How we appreciate everything you do!