Wall Street Bonuses! Did you get yours yet? No? You must not work on Wall Street, then! You don’t matter in this world!

Down to business.

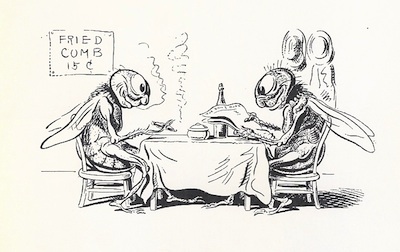

I have to confess that I descended into the bowels of the earth yesterday, and visited the BileMaster. And I drank some of the brew he makes. It’s awful; tastes like quinine mixed with Gatorade. But you find you can’t stop drinking it, so I had a lot. **

Afterwards, your vision is tinged sort of greeny-yellow with red streaks running down it. Or maybe those red streaks are just the blood running into my eyes from the gash on my head. I don’t know how I got that. I don’t really remember what I did most of the evening.

Today, I find I hate everything. Filth surrounds us. And everyone is a crook, I think. I look around and I see crooks on every side. Crooks, crooks, crooks….

I’m really sorry; I don’t usually talk like this. It’ll take another day or so to get back to normal, so I’ll just get this off my chest and out of my system while I’m waiting to recover my usual sweet self and sunny outlook. So read this, you bastard!

Again — I’m sorry. Hard to control myself.

…..

The President says it was “instant gratification” that fueled the bust of the economy? Not precisely. Instant gratification is to blame for the proliferation of the microwave, Tivo, millions of TV channels, and lots of other stuff like that. The growth of the economy is not equal to the bust of the economy. And that’s what the “culture” of instant gratification helped along: the growth. Not the bust.

It was people doing things that they found they could get away with, because the general public didn’t know about it. It was hidden, greedy crime. That’s what started the bust. Then it was the mismanagement of all the financial institutions dealing with the outcome of that hidden greediness.

No one in the past seemed to consider the big lack of savings accounts on the part of the middle class “the economy” — so let’s not call it that now. Our savings never really figured into things, at least in the last half-century. Only our spending did.

“The economy” still doesn’t care about us. But it will when we’re older, or broke, and out on the street. Then we finally become part of “the economy” because we’re so very visible. Big, out on the streets, demanding answers. Just like Godzilla.

The Duplicitous Products

Back in the early 90s, I thought that America’s main product that the world needed, or at least wanted, was military force and weapons. (Both our army itself, and our weapons manufacturing.) It seemed that the world’s use of us was to make us the police officer of the globe. Or so it seemed to me for about five minutes.

Now, the U.S. supplies the world with things it didn’t really ask for. Except maybe the bankers and finance guys. They would have wanted these things.

What are our products? The credit default swap. Wall Street bonuses as a pay system. The bundled, insured, diced-up bunch of toxic loans. The practice of demanding from customers multitudes of hidden fees that no one thought of charging for, until lately. Duplicitous products of finance and business!

Did you know that fully HALF of the people who received loans from companies like Countrywide, who ended up with Adjustable Rate Mortgages and subprime loans, actually qualified for prime rate loans? That’s fifty percent. That is NOT the poor being enabled to buy houses. That’s regular borrowers duped into signing stuff they didn’t know they were signing. They were conned into putting their names down for ballooning mortgage payments.

This is as good, or better, than the scams of the eighties, when banks were scammed by fake borrowers who took out big loans to flip real estate and other stuff, and eventually just walked off with the money. Of course the fake borrowers were usually also people from banking, who knew how to work the banking system.

This is as good as Enron. As good as manipulating the energy market of the largest state in the nation. As great as Wall Street bonuses. As good as the Bush election in 2000.

…

If you don’t own a bunch of stock, WHY on earth do you worry how the stock market does? (And why are the news media trying to make it so important?) That’s like taking the temperature of your neighbor down the block to see if YOU have a fever or not.

WHY is the credit default swap still a legal transaction? Or is Wall Street simply a bookie operation? Is AIG one?

WHY hasn’t shorting stock been severely restricted already?

I suspect everything and everyone in business now. That’s what the stream of revelations of the machinations of the financial corporations has done to me. For instance, I turn on the TV, there’s this American Idol show running over its time into the next hour. I wonder why — because that never happens. TV ad time is so expensive.

It was planned, I think. A little gimmick that made some sneaky people money in a new way. In the ten minutes of that show overlap, sensation/surprise Adam Lambert sang so prettily. He was:

1) Seen by a whole lot of people who never ordinarily watch American Idol. These accidental viewers were waiting for the show Fringe, which has a very different audience.

2) Missed by the regular viewers of Idol who DVR’d the episode, who probably set their recording devices to correspond with the normal time of the show. They missed the overrun of 10 minutes.

3) Yanked off Youtube.com, which in the first few hours afterwards, showed that video of the last 10 minutes. Now it does not, and people are rabidly searching for it. (He was that interesting, yes.)

4) Sold hugely on iTunes. That 10-minute performance from TV (trimmed down) is now for sale there. The planners managed to keep it exclusive by making it run past its time.

Just an interesting little experiment that was probably very successful.

But the bigger arena of business artistry is elsewhere: the fees that credit card companies, banks, cell phone companies, and other companies have found they could charge us. More examples of American creativity!

It’s hard to list all those newfangled fees that have cropped up in the last year or two. We’ll post a short list of some examples soon. And you’ll soon be noticing those and zillions more, every time you open your eyes. Or your mail.

**The BileMaster evidently sold a batch of his brew to Kenya once. http://news.bbc.co.uk/2/hi/africa/1025120.stm And Alan Turing (father of the Turing Machine) may have eaten an apple dipped in it. It’s bad stuff.

, sick of AIG’s yacht-loving executive, and Ted Geithner and Larry Summers and Bernanke! Very sick of them. Instead, I’m thinking about social ism today. I avoided putting it in one word so you wouldn’t choke; I know how Americans don’t like saying or hearing the word. It’s as if you all lived during the 50s.

, sick of AIG’s yacht-loving executive, and Ted Geithner and Larry Summers and Bernanke! Very sick of them. Instead, I’m thinking about social ism today. I avoided putting it in one word so you wouldn’t choke; I know how Americans don’t like saying or hearing the word. It’s as if you all lived during the 50s. in the first paragraph go without putting the word pig beside it.

in the first paragraph go without putting the word pig beside it.